Overview

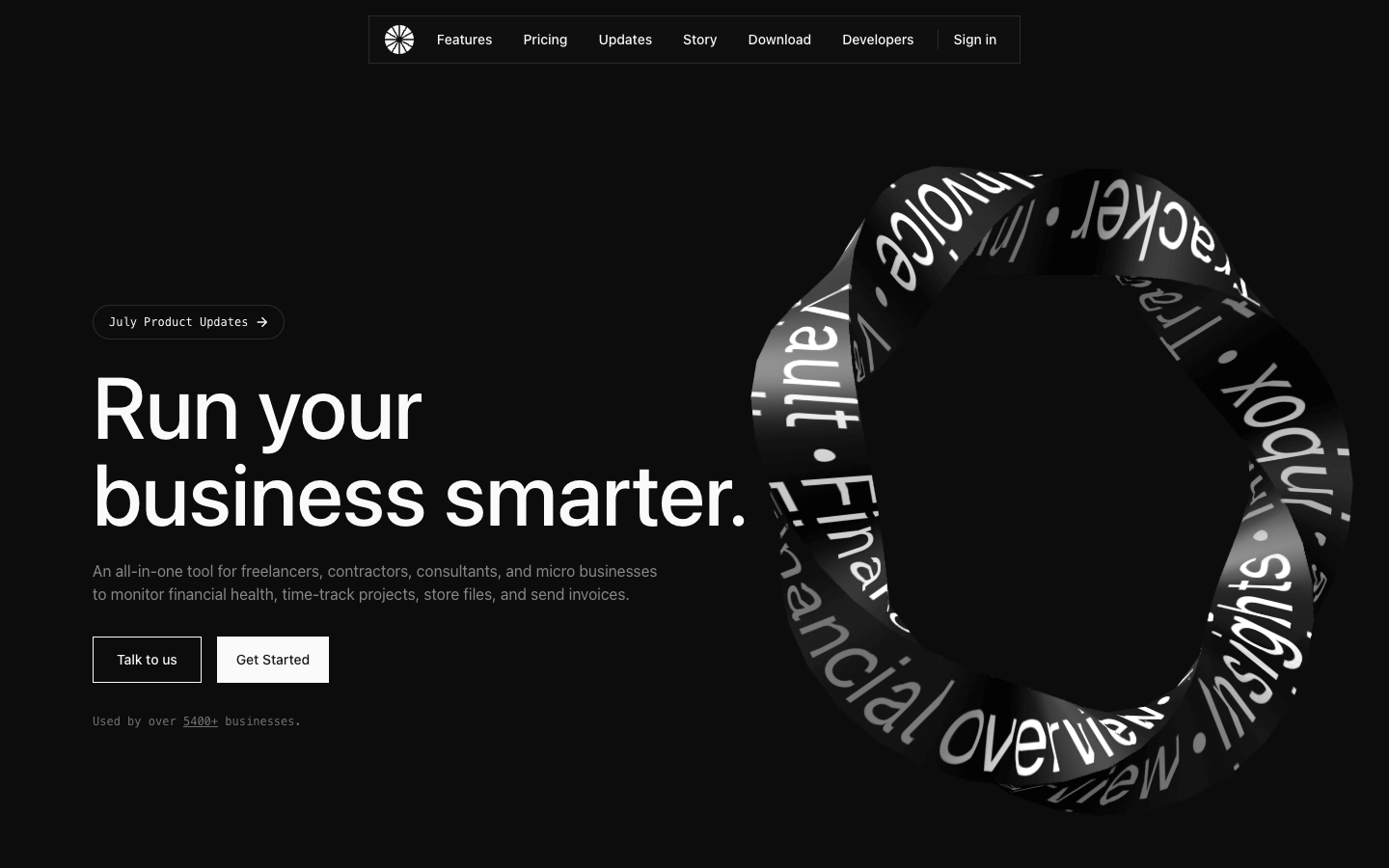

Midday is a comprehensive AI-powered tool designed to streamline business operations for freelancers, contractors, consultants, and micro businesses. It offers a robust suite of features including financial monitoring, project time tracking, file storage, and invoice management. Midday connects seamlessly with over 20,000 banks across multiple countries, providing real-time financial insights and ensuring effortless financial management. Its automated systems simplify receipt-to-transaction mapping, file organization, and invoicing, reducing manual effort and enhancing productivity. The platform's assistant feature provides tailored insights into financial data, helping users make informed decisions. Midday is an open-source solution committed to transparency and continuous improvement through community contributions.

Core Features

Real-time financial monitoring

Automated receipt-to-transaction mapping

Secure file storage

Advanced time tracking for projects

Seamless invoice management

Integration with over 20,000 banks

Tailored financial insights via assistant

Effortless data export for accounting

Customizable email for invoices and receipts

Open-source platform

Use Cases

Tracking business expenses and income

Automating invoice generation and management

Storing and organizing contracts and agreements

Monitoring project timelines and progress

Gaining insights into financial health

Matching receipts to transactions automatically

Exporting financial data for accounting purposes

Collaborating on invoices in real-time

Keeping track of missing or pending receipts

Reducing manual administrative tasks

Pros & Cons

Pros

Comprehensive financial insights

Automated transaction matching

Secure file storage

Advanced project tracking

Seamless invoicing

Extensive bank integration

Tailored financial advice

Easy data export

Custom email for documents

Open-source transparency

Cons

Learning curve for new users

Limited to supported banks

Feature-rich interface complexity

Dependence on internet connectivity

Potential privacy concerns

Occasional syncing issues

Limited offline functionality

Beta features may be unstable

Potential integration challenges

Subscription cost after beta

FAQs

Video Review

Midday Alternatives

Namelix

Business name generator

AI PowerPoint Maker

AI presentation generator for PowerPoint

Tettra

Answer repetitive questions and onboard new teammates faster

Cody AI

Boost Your Teams Productivity With AI

TextCortex

One AI copilot that truly gets you.

Founderpal

Marketing tools for Solopreneurs who hate marketing

Fork.ai

Identify Technologies on Mobile App

Relevance AI

Build your AI Workforce

Photo AI

Create beautiful AI photos and videos without a camera

Octane AI

AI That Grows Your Ecommerce Business

Copyleaks

AI-based text analysis to help create and protect original content

Lindy.ai

Transform Your Workflow with Lindy.ai's AI Assistant

Instantly.ai

Cold Email Software

Unbounce

Convert 30% more with high-performing landing pages

GPTBots.AI

Powerful Business AI Bot Platform for Everyone

Spokk

Increase your Sales with Private Customer Feedback & Public Reviews

Logiclister AI

Empowering Ecommerce: Navigate Your Business with AI!

Aidaptive

Autonomouse Intelligence Platform for Digital Commerce

Featured

Blackbox AI

Accelerate development with Blackbox AI's multi-model platform

Genspark AI

Your All-in-One AI Workspace

TurboLearn AI

AI Note Taker & Study Tools

AI PDF Assistant

AI PDF Assistant is an intelligent recommendation tool

Kimi AI

Kimi AI - K2 chatbot for long-context coding and research

Un AI my text

“Where AI Gets Its Human Touch.”

Winston AI

The most trusted AI detector

Abacus AI

The World's First Super Assistant for Professionals and Enterprises

Sora 2

Transform Ideas into Stunning Videos with Sora 2

ChatGPT Atlas

The browser with ChatGPT built in

Hailuo AI

AI Video Generator from Text & Image

Animon AI

Create anime videos for free